Get Funded Instantly

No challenge, no complex rules, instant Payouts.

Immediate access, endless opportunities.

Testimonials

Very trustworthy and great prop firm to work with. Highly recommended!!!

Fast payout (less than 24 hours)

iFunds has been a game changer in my trading career. Only- a maximum overall loss limit of 10%, not even the daily DD!

Funded with several prop firms and can say iFunds has the fastest payout time. Got a payout in literally 5 hours. Other firms take days or weeks.

Excellent experience with this prop firm. Withdraw in less than 24 hours, without rules and instant funding. They are the best options on the market right now.

Service and feedback super fast!

A rapidez e praticidade de tudo

Ottima esperienza di deposito è di prelievo...Entrambi acquisiti in giornata stesso...

Excellent funding company without challenges and rules, I have withdrawn my profit, and it did not take more than 3 hours after the request.

Efficient customer service, resolved a payment issue quickly.

Efficient customer service, resolved a payment issue quickly.

Excellent funding company without challenges and rules, I have withdrawn my profit, and it did not take more than 3 hours after the request.

Ottima esperienza di deposito è di prelievo...Entrambi acquisiti in giornata stesso...

A rapidez e praticidade de tudo

Service and feedback super fast!

Excellent experience with this prop firm. Withdraw in less than 24 hours, without rules and instant funding. They are the best options on the market right now.

Funded with several prop firms and can say iFunds has the fastest payout time. Got a payout in literally 5 hours. Other firms take days or weeks.

iFunds has been a game changer in my trading career. Only- a maximum overall loss limit of 10%, not even the daily DD!

Fast payout (less than 24 hours)

Very trustworthy and great prop firm to work with. Highly recommended!!!

Your Trading Capital Accelerator

Fair Rules

We replaced the unnecessary complexities of Prop Trading with a single Max Drawdown rule, providing a clear guidance for risk management.

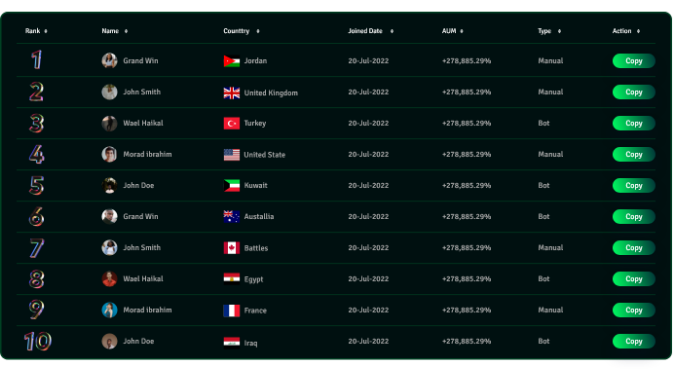

Public Leaderboard

We set the stage for you to showcase your performance in a fully transparent leaderboard, opening doors of opportunity.

Seamless Scaling

Utilize your profit to scale up your account to the next tier, no profit target is required, and no wipeout of any excess profits.

On Demand Payout

Why Prop Traders Prefer iFunds?

Instant Funding up to $500k

The lower Max Drawdown you choose, the higher Profit Split you receive. Tailor your funded account based on your risk appetite.

Copy-Trading Leaderboard

To support our traders regardless of their performance, we offer our top performing traders the opportunity to be featured on our public leaderboard and monetize their performance by allowing other traders to copy their trades for a fee.

Get Funded

Why To Choose iFunds?

Subscribe to

Our Newsletter

Frequently asked questions

An instant funding proprietary trading firm provides traders with capital to trade the financial markets. Unlike traditional trading firms, they offer immediate access to funding without time-consuming evaluations.

When you trade with iFunds, either on a challenge or a funded account, you are assigned a portion of our own capital so you can trade on iFunds’ behalf (directly from our trading pool account). To facilitate this process, iFunds provides each trader with a dedicated account on a 3rd party platform with access to superb market execution through our sophisticated proprietary technology.

Traders are evaluated based on their performance, and successful traders receive the predefined profit split as long as they adhere to the maximum loss limit and our Terms and Conditions.

With iFunds, you will be able to trade various markets, including stocks, currencies, metals, energies, and cryptocurrencies.

You will be disqualified if you hit the maximum allowed loss (Max DD) or if you use a market manipulation trading technique such as latency arbitrage.

Yes, you can trade from different locations using multiple IP addresses with no limitations.

No, we believe that consistency rules are counterproductive, and traders should have the freedom and flexibility to trade different market conditions.

No, iFunds funded accounts are not subject to a Daily Drawdown limit. Only Maximum Drawdown is applicable.

Yes, we don’t have any restriction on copy-trading as long as the trades are not deemed of market manipulative techniques.

Yes, our internal copy trading system offers traders the opportunity to monetize their trading performance by charge subscription fees to other traders who choose to copy their trades.

Our copy-trade leaderboard is updated automatically reflecting the top traders based on their respective ROI. All you need to do is to start trading, have positive earnings and you will automatically be featured on the leaderboard with a full analysis on your account.

As soon as you achieve the minimum withdrawable profit threshold ($50), you can use your profit to scale up your funded account to the next plan and pay the price difference at a discounted rate.

However, if you have excess profits than needed to pay the price difference, the remaining profit amount will be transferred to your new upscaled account and will be available for withdrawal.

There are not limitations on the withdrawals, you can withdraw any profited amount above $50 anytime with no waiting period.

Unlike classic prop firms, taking our challenge is optional. You do not need to go through challenge phases to prove yourself. You can immediately start trading and receiving payouts from day one.

The minimum amount allowed to be withdrawn is as low as $50.

You can request payout on demand, we will process your payout within 24 hours, or we will pay you 10% extra, up to $1000.

Yes, you can use your own AutoTrading Robot (EA) or any third-party AutoTrading Software on your account as long as it doesn’t use any manipulation technique such as latency arbitrage HFT or other methods that are deemed to be abusive by our Liquidity Providers.

English

English  Portuguese

Portuguese  Italian

Italian  Arabic

Arabic  Spanish

Spanish  Chinese

Chinese